Pub 17 Tax Guide

- Main Points

- Who, What, When, Where, How to file

- What records to keep and how long, How to amend filings

- Pub. 17 closely follows Form 1040

- Not in this publication

- Pub. 334, Tax Guide for Small Business

- Pub. 225, Farmer’s Tax Guide

- Pub. 587, Business Use of Your Home (Including Use by Day-Care Providers)

For IRS Video Information: IRS YouTube

W/H = Withholding

SS = Social security

AGI = Adjusted gross income

Chapter 1. Filing Information

New for 2023, Reminders & Introduction

- Child tax credit –> 1,600 for each qualifying child

- Clean vehicle credit (New):

- Use Form 8936 & and Schedule A (Form 8936) & 1040-Schedule 3, line 6f:

- Previously owned clean vehicle credit:

- Use Form 8936, credit is available for previously owned clean vehicles

- See IRS Video Inflation Reduction Act: New and Used Clean Vehicles

“The credit is lesser of $4,000 or 30% of the sales price of the previously owned clean vehicle you acquired and placed into service that year.”

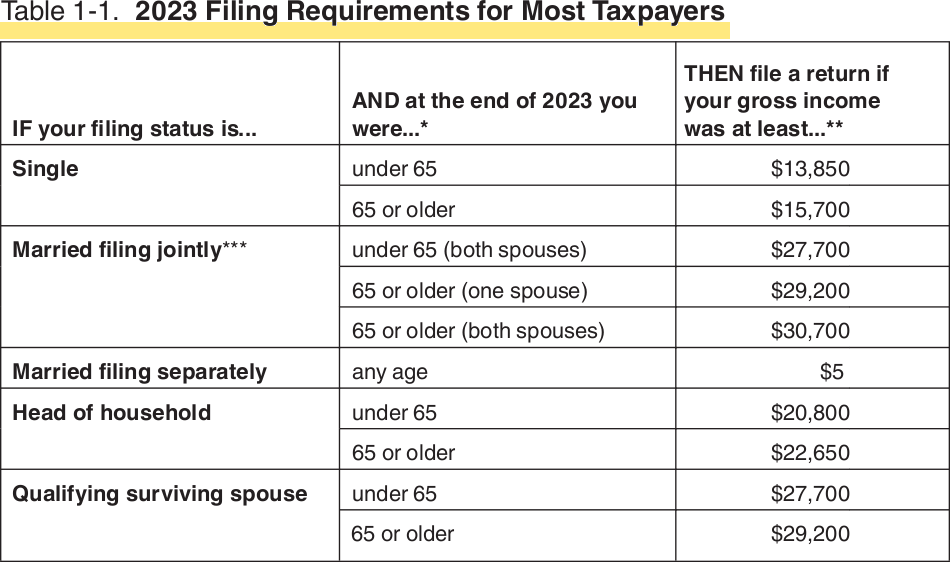

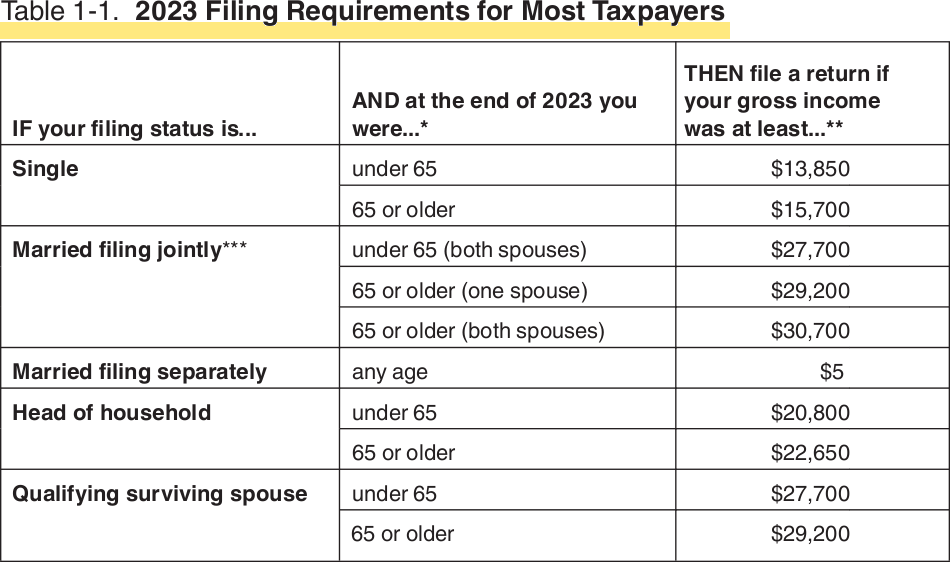

- Who must file

1-1: Filing Requirements Table

| Table 1-1, Gen. Filing |

|---|

|

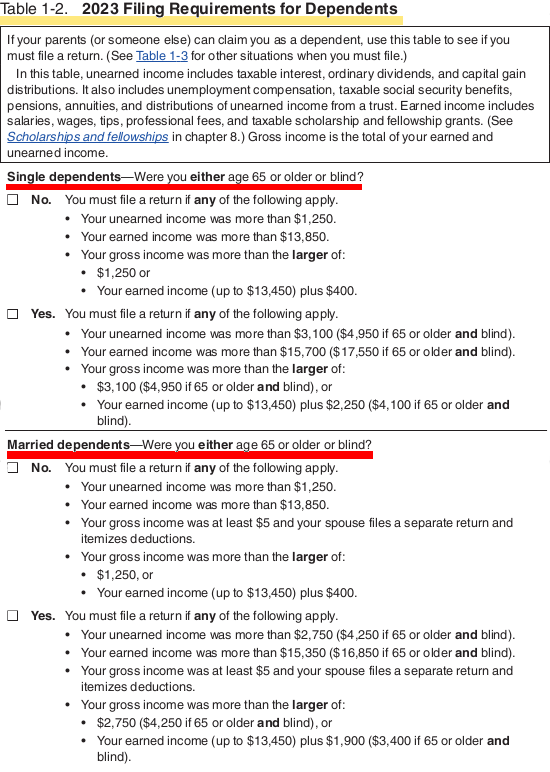

1-2: Dependents Table

| Table 1-2, Filing with Dependents |

|---|

|

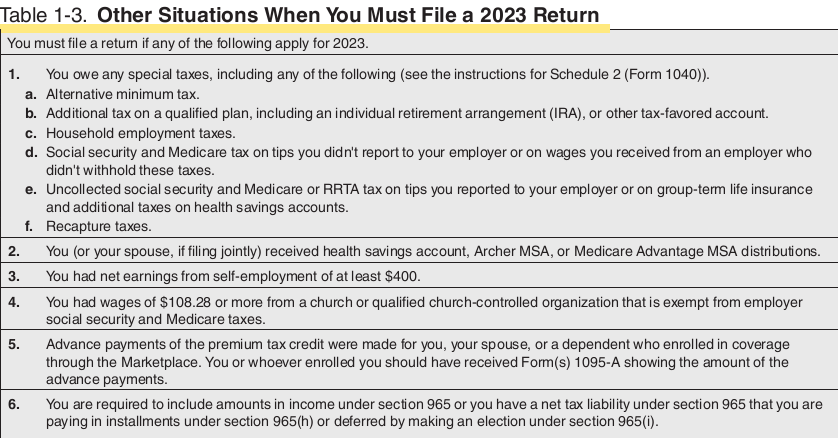

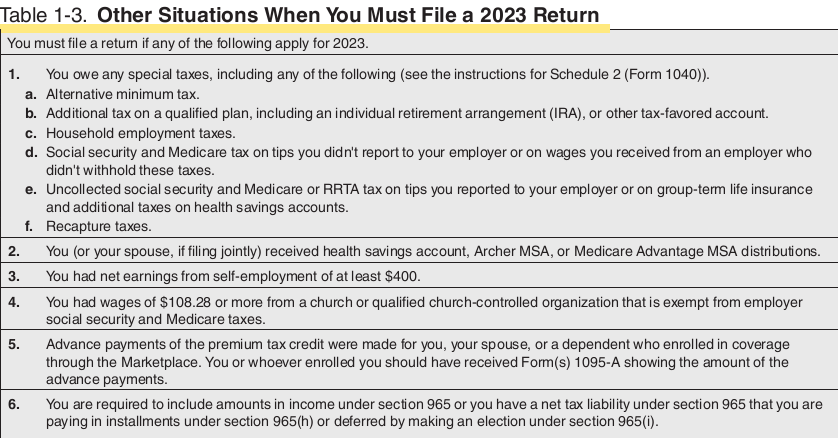

1-3: Other Situations Table

| Table 1-3, Other Situations to File |

|---|

|

- Standard Deductions for 2023:

| Single, Married filing separately |

Married filing jointly, Qualifying surviving spouse |

Head of household |

|---|---|---|

| 13,850 | 27,700 | 20,800 |

- Schedule 3-1040 Add’ns

- Line 5a –> Form 5695, Residential clean energy credit

- Line 5b –> Form 5695, Energy efficient home improvement credit

- Line 6m –> Form 8936, Credit for previously owned clean vehicles

- Line 13c –> Form 3800, Elective payment election amount

- Credits for qualified sick and family leave wages:

- Use 1040 Schedule H & Schedule 3, line 13z

-

Alternative motor vehicle credit –> Expired

- Self-employed health insurance deduction:

- Use Form 7206, Self-Employed Health Insurance Deduction

- report on 1040 Schedule 1, line 17

- 1X Charitable distribution: 2023 –> distribute < 50K from IRA

- Increase required minimum distribution age –> 72yr

- Use Pub. 590–B, Distributions from Individual Retirement Arrangements (IRAs)

- 2023 IRA contribution limit increased to:

- The IRA contributions limit is $6,500.

- If you’re 50 or older, the limit is $7,500.

- Before 2023, Was 6,000 and 7,000.

- In 2023, if you’re in a 401(k), 403(b), or the federal Thrift Savings Plan, THEN you can now contribute up to $22,500 per year. If you’re 50 or older, the limit is $30,000.

- This also applies to most 457 plans.

-

Insurance premiums for retired public safety officers: can now exclude 3 K from income

- There are exceptions to the 10% extra tax for taking money out of a retirement plan early. These exceptions include:

- Distributions related to federally declared disasters.

- Distributions made to someone who is terminally ill.

- Distributions to firefighters who are either 50 years old or have 25 years of service under their plan.

- See: Form 5329 and Publication 590-B.

-

See:

www.irs.gov/directfile -

Health Flexible Spending Act (HFSA) under cafeteria plans = 3,050, under section 125(i) on voluntary salary redux.

-

Temp. allowance of 100% business meal deduction: Expired, section 210.

-

Diaster tax relief - See Disaster-Related Relief in Pub. 590-B

-

Distributions to terminally ill individuals. The exception to the 10% additional tax for early distributions is expanded to distributions made after 12/29/2022, to a certified individual. See Pub. 590-B

- Starting 12/29/2022, the 10% additional tax on early IRA distributions won’t apply to income from a corrective distribution, as long as the correction is made by the tax return due date (including extensions).

- Follow up?

- The IRS cannot issue refunds before mid-February 2024 for returns that claim Additional child tax credit (ACTC).

- Standard mileage rates

| Business | Charitable organizations | Medical |

|---|---|---|

| 65.5 cents | 14 cents | 22 cents |

- In 2023, if you’re covered by a retirement plan at work, your ability to deduct contributions to a traditional IRA is reduced if your modified adjusted gross income (AGI) is:

- Between 116,000 and 136,000 for married couples filing jointly or qualifying surviving spouses.

- Between 73,000 and 83,000 for single individuals or heads of household.

- Less than $10,000 for married individuals filing separately.

- If your spouse is covered by a retirement plan at work but you aren’t, your deduction is reduced if your modified AGI is between 218,000 and 228,000. If it’s 228,000 or more, you can’t deduct contributions to a traditional IRA.

- For more information, see Chapter 9, How Much Can You Deduct.

| Married filing jointly, Qualifying surviving spouse |

Single, Head of household |

Married filing separately |

|---|---|---|

| Between 116,000 and 136,000 | Between 73,000 and 83,000 | Less than 10,000 |

-

Roth IRA contributions, RE: Modified AGI limit for The Roth IRA contribution limit is reduced (phased out) in the following situations.

-

Your filing status is married filing jointly or qualifying surviving spouse and your modified AGI is $\geq$ 218K. You can’t make a Roth IRA contribution if your modified AGI $\geq$ 228K.

-

Your filing status is single, head of household, or married filing separately and you didn’t live with your spouse at any time in 2023 and your modified AGI is $\geq$ 138K. You can’t make a Roth IRA contribution if your modified AGI is $\geq$ 153K.

-

Your filing status is married filing separately, you lived with your spouse at any time during the year, and your modified AGI is more than zero. You can’t make a Roth IRA contribution if your modified AGI is $\geq$ $10K. See Can You Contribute to a Roth IRA in chapter 9, later.

-

-

In 2023, your ability to contribute to a Roth IRA is reduced in these cases:

- If you’re married filing jointly or a qualifying surviving spouse, your contributions are reduced if your modified AGI is $218,000 or more. You can’t contribute if your AGI is 228,000 or more.

- If you’re single, head of household, or married filing separately (and didn’t live with your spouse in 2023), contributions are reduced if your modified AGI is 138,000 or more. You can’t contribute if your AGI is 153,000 or more.

- If you’re married filing separately and lived with your spouse during the year, your ability to contribute is reduced if your modified AGI is more than 0. You can’t contribute if your AGI is 10,000 or more.

- See Chapter 9, Can You Contribute to a Roth IRA.

-

1099-K - 1099-K is issued by third parties (like Uber, Lyft, Etsy, etc) to report payment transactions made to you for goods and services. You must report all income on your tax return unless excluded by law, whether you received the income electronically or not, and whether you received a Form 1099-K or not. The **box 1a and other amounts reported on Form 1099-K are additional pieces of information to help determine the correct amounts to report on your return.

- If you received a Form 1099-K that shows payments you didn’t receive or is otherwise incorrect, contact the Form 1099-K issuer, not the IRS.

- If you can’t get it corrected, or you sold a personal item at a loss, see the instructions for Schedule 1, lines 8z and 24z, see reporting information &

www.irs.gov/1099k.

- Do I Have To File A Return?

**NOTE - US and Puerto Rican residents must file even if you don’t owe tax.

- Three determining factors for filing

- Gross income

- Filing status

- Age

- FREE Filing Programs (or low-cost), if adjusted gross income (AGI) is < ~64K

| # | Site | Age | Dollar | Fed | State |

|---|---|---|---|---|---|

| 1 | 1040.com | Any | 17k < x < 79k | All states | Some |

| 2 | 1040NOW.NET | Any | < 68k | Some states | No |

| 3 | OLT.com | Any | <= 45k | All states | All |

| 4 | FileYourTaxes.com | <= 64 | <= 45k | All states | Some |

| 5 | FreeTaxUSA | Any | 8.5k <= x <= 45k | All states | All |

| 6 | TaxSlayer | Any | <= 45k | All states | Some |

| 7 | TaxAct | 20 <= age <= 58 | <= 45k | All states | Some |

| 8 | ezTaxReturn.com | Any | <= 79k | Some states | No |

- Access your online account:

www.irs.gov/account- IRS web info

- View address(es), manage communications

- Make payments. See & set up payment plans, payment history

- Access tax records = transcripts

- Approve or reject authorization requests from tax professionals

www.irs.gov/secureaccessfor identity authentication process.

-

Change of address: Form 8822

-

ONE NEEDS: SSN, ITIN, ATIN

-

1.2.7 Installment agreement

-

See Install agreement section?

-

Automatic 6-month extension: Form 4868

-

1.2.9 Service in combat zone

-

Allowed extra time, See section?

-

1.2.10 Adoption taxpayer identification number

-

See section?

-

1.2.11 Taxpayer identification number for aliens

- Doesn’t have & isn’t eligible to get a social security number, Use/file Form W-7

www.irs.gov/itin: Individual taxpayer identification number (ITIN) renewal

- Frivolous tax submissions

- The IRS has published a lists of frivolous positions. WHERE?

- Penalty –> 5,000 per submissions, see Civil Penalties

- Gross income

- All forms of money, goods, property & services that aren’t exempt from tax

- Include income from outside the U.S or from the sale of your main home

- Social security benefits if:

- You were married & filing a separate return

- Half of your S.S. benefits plus(+) gross income & any tax-exempt interest is $\gt$ 25 K or

- $32 K filing jointly

- Community property states:

- Form 8958, Allocation of Tax Amounts Between Certain Individuals in Community Property States

- Pub. 555, Community Property

- Schedule F-Form 1040

- Include Arizona, California,Idaho, Louisiana, Nevada, New Mexico, Texas, Washington & Wisconsin

- Self-employed individuals:

- SEE: line 7 of Schedule C (Form 1040) Profit or Loss From Business & line 9

- Surviving Spouses, Executors, Administrators & Legal Representatives:

- Pub. 559, Survivors, Executors, and Administrators

- MUST file a final return for a decedent, IF you are executor, administrator, or legal representative

- U.S. Citizens & Resident Aliens Living Abroad:

- Pub. 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad

- See Tables 1-1,2,3

- Residents of Puerto Rico, Guam, The Northern Mariana Islands, American Samoa, or the U.S. Virgin Islands

- Pub. 570

- See Table 1-1,3

| MAKE LINKS |

|---|

|

|

-

DEPENDENTS

-

Responsibility of parent

- Generally, children ARE responsible for filing & paying

- If a child cannot then adult MUST, also adult must sign child’s name:

“By (your signature), parent for minor child.”

- Child earnings are (Generally) included in the child’s Gross Income & not parents, AGI.

- IF child does not pay the adult is liable.

- Children < 19yr or FT Students:

- Form 8814

- If a child’s only income is interest & dividends & child $\leq$ 19 or full-time student $\leq$ 24, parent can include the child’s income on the parent’s return.

- The child can choose to lump income together:

- See: i8814, Parents Election To Report Child’s Interest & Dividends

- Self-Employed: Pub. 334, Tax Guide for Small Business (Schedule C)

- Are a sole proprietor, An independent contractor, member of a partnership, or anything else.

- Must file Form 1040 or 1040-SR OR Schedule SE (Form 1040), Self-Employment Tax IFF:

- $\gt$ $400 from self-employment (excluding church employee income) or

- Church employee income $\gt$ $108.28

- See Table 1-3

- Employees of foreign governments or international organizations

- If you’re from U.S. in the U.S. and work for an international org & your org. doesn’t withhold Social Security & Medicare taxes (therefore you are Self-employed

- Calculate self-employment taxes

- Ministers: Pub. 517, Like Self-employed

- Aliens: Pub. 519, Tax Guide for Aliens

- See also 1040-NR, Nonresident Alien Income Tax Return

| Resident alien | Nonresident alien | Dual-status taxpayer |

|---|---|---|

| Same rules as US citizens | Some rules like US citizens, min. exceptions | Different rules based on % in country |

- 1.9 Who Should File: See Pub. 596, 970, 974

- Even if you don’t have to file, you should to get your money back if:

- Had tax W/H or Est. your tax or any tax credit

- To Qualify for Earned income credit, Use Pub. 596

- For Premium tax credit, Use Pub. 974

- For American opportunity credit, Use Pub. 970

- Three basic Filings: 1040 & 1040-SR & 1040-NR

- SR = for seniors,

- NR = Non-residents

-

Self-Select PIN, See: -

-

Practitioner PIN

- allows one to authorize your tax practitioner to enter or generate your PIN. Your electronic return is considered a valid only when it includes your PIN; last name; date of birth; and IP PIN

- If filing jointly one needs ALL Spouse info. -

Form 8453

- Identity Protection PIN, See:

- See: Publication 5477, All taxpayers now eligible for Identity Protection PINs

- IP-PIN video

- How to get IP-PIN

- IP PIN TOOL

- Power of attorney (POA)

- Attach Form 8453

- Refunds, See:

- Offset against debts - The IRS may take all or part of your refund to past-due amounts

- For inquiries: Use App

- Penalities and Interest - Interest is charged from the due date of your return, even if you get an extension. Penalities (failure-to-file penalty) is ~5% for each month or part of a month that it is late, but not more 25%.

- Free Help With Your Return

- Volunteer Income Tax Assistance, VITA

- VITA offers free tax help to low-income taxpayers, persons with disabilities, and those with limited English proficiency.

- IRS.gov/VITA

- download the *free IRS2Go app,

- call 800-906-9887 to find the nearest VITA location

- Tax Counseling for the Elderly, TCE

- The Tax Counseling for the Elderly (TCE) program specializes in tax issues related to pensions and retirement.

- IRS.gov/TCE, etc. to find the nearest TCE location

- When Using a Tax Professional (ADD MORE??)

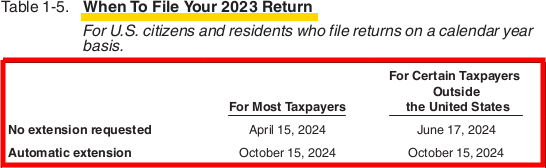

When Do I File?

Dates & Extentions Table

| When To File |

|---|

|

- LATE Filing

- Penalities and Interest - Interest is charged from the due date of your return, even if you get an extension. Penalities (failure-to-file penalty) is ~5% for each month or part of a month that it is late, but not more 25%.

- Filing for a decedent

- See **Pub. 559 - Survivors, Executors and Administrators

- Extensions of Time To File, Automatic Extension

- **Form 4868 - Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

- Extensions $\geq$ 2 month, Use:6 months

- For Non-resident alien

- If you earned in the US, then 4/15

- If you don’t earn wages subject to W/H, then 6/15. ????

- Qualified hospitalization

- Any hospitalization outside the US (eg. military)

- Up to 5 years in the US

- See: See Pub. 3, Armed Forces’ Tax Guide

- Included in medical expenses amounts are the cost of inpatient care if you are there for treatment, this includes for meals and lodging.

6 Steps for Preparing Your Paper Return

| Table 1-6. Six Steps for Preparing Your Paper Return |

|---|

| 1. Collect all records |

| 2. Collect forms, schedules, publications |

| 3. Fill in return |

| 4. Check return |

| 5. Sign & Date return |

| 6. Attach all req’d forms & schedules, Send In |

- Substiture forms

- In general, you cannot yuse your forms

- BUT se also Pub. 1167, General Rules and Specifications for Substitute Tax Forms and Schedules

- Where Do I File?

Accounting Periods

Most people use a calendar year for their tax returns, covering January 1 to December 31. If you don’t, you’re using a fiscal year, which is any 12-month period ending on the last day of a month other than December. A 52-53 week fiscal year lasts between 52 and 53 weeks and ends on the same day of the week each year. You choose your accounting period (tax year) when you file your first tax return, and it can’t be longer than 12 months. For more details on accounting periods or how to change them, see Publication 538.

Accounting Methods

Your accounting method is how you record income and expenses. Most people use either the cash or accrual method. You choose one when you file your first return, and to change it later, you need IRS approval. Use Form 3115 to request a change.

- Cash Method: You report income when you actually receive it and deduct expenses when you pay them. Most individuals use this method.

- Constructive Receipt: You’re considered to have received income if it’s available to you, even if you haven’t physically received it. For example, interest credited to your bank account on December 31 is taxable in that year, even if you withdraw it later.

- Garnished Wages: If your wages are garnished or used to pay debts, you must include them in your income.

- Debts Paid for You: If someone cancels or pays your debts (not as a gift or loan), you must include it in your income.

- Payments to a Third Party or Agent: If someone else is paid from your property or an agent receives income for you, it’s considered your income when they receive it.

- Checks: A check made available to you before the end of the tax year counts as income for that year, whether or not you cash it.

-

If there are circumstances where you don’t have access to the income, you might not have “constructively received” it.

-

Example: A teacher agrees to only receive the difference between their salary and the cost of a substitute teacher. The amount deducted for the substitute is not considered “constructively received.”

-

Accrual Method: You report income when you earn it, not when you receive it, and you deduct expenses when you incur them, not when you pay them.

-

Advance Payments: Any payments you receive in advance, like rent or interest, are generally included as income in the year you receive them, regardless of your accounting method. However, a limited deferral may apply for certain payments.

-

See Publication 538, Accounting Periods and Methods

2. Filing Status

2.1 What’s New & Reminders

-

Filing status rules

-

Tax benefits for married taxpayers

-

Filing Status Categories

-

Single

-

Married Filing Jointly

-

Married Filing Separately

-

Head of Household

-

Qualifying Surviving Spouse

-

3. Dependents

What’s New

- Child & Dependent Care Credit

Reminders

- Dependent Rules

Introduction

- Who Can Claim a Dependent?

Qualifying Child

Qualifying Relative

4. Tax Withholding & Estimated Tax

-

What’s New

- Changes in Tax Withholding

-

Reminders

-

Estimated Tax Payments

-

Changes in Taxable Income

-

Introduction

-

Understanding Tax Withholding

-

W-4 Forms

-

Adjusting Your Withholding

APPENDIX: Publications & Forms Mentioned

TOTAL

- **Pub. 5 - Your Appeal Rights and How to Prepare a Protest if You Don’t Agree

- **Publication 216 - Conference and Practice Requirements

- **Pub. 225 - Farmer’s Tax Guide

- **Pub. 463 - Travel, Gift, and Car Expenses

- **Pub. 501 - Dependents, Standard Deduction

- **Pub. 502 - Medical and Dental Expenses

- **Pub. 503 - Child and Dependent Care Expenses

- **Pub. 504 - Divorced or Separated Individuals

- **Pub. 505 - Tax Withholding and Estimated Tax

- **Pub. 519 - Tax Guide for Aliens

- **Pub. 523 - Selling Your Home

- **Pub. 524 - Credit for the Elderly or the Disabled

- **Pub. 526 - Charitable Contributions

- **Pub. 527 - Residential Rental Property (Including Rental of Vacation Homes)

- **Pub. 531 - Reporting Tip Income

- **Pub. 534 - Depreciating Property Placed in Service Before 1987

- **Pub. 535 - Business Expenses

- **Pub. 547 - Casualties, Disasters, and Thefts

- **Pub. 551 - Basis of Assets

- **Pub. 555 - Community Property

- **Pub. 556 - Examination of Returns, Appeal Rights, and Claims for Refund

- **Pub. 561 - Determining the Value of Donated Property

- **Pub. 570 - Tax Guide for Individuals With Income from U.S. Possessions

- **Pub. 575 - Pension and Annuity Income

- **Pub. 590-A - Contributions to Individual Retirement Arrangements (IRAs)

- **Pub. 590-B - Distributions from Individual Retirement Arrangements (IRAs)

- **Pub. 596 - Earned Income Credit (EIC)

- **Pub. 936 - Home Mortgage Interest Deduction

- **Pub. 966 - Electronic Federal Tax Payment System (EFTPS)

- **Pub. 970 - Tax Benefits for Education

- **Pub. 971 - Innocent Spouse Relief

- **Pub. 1546 - The Taxpayer Advocate Service is Your Voice at the IRS

- **Pub. 4134 - Low Income Taxpayer Clinic List

-

**Pub. 5250 - Pay by Cash

- **Form W-4 - Employee’s W/H Certificate

- **Form W-4V - Voluntary W/H Request

- **Form 706 - United States Estate (and Generation-Skipping Transfer) Tax Return

- **Form 709 - United States Gift (and Generation-Skipping Transfer) Tax Return

- **Form 1040X - Amended U.S. Individual Income Tax Return

- **Form 1040-ES - Estimated Tax for Individuals

- **Form 1041 - U.S. Income Tax Return for Estates and Trusts

- **Form 843 - Claim for Refund and Request for Abatement

- **Form 1099C - Cancellation of Debt

- **Form 1099R - Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- **Form 1116 - Foreign Tax Credit

- **Form 1127 - Application for Extension of Time for Payment of Tax Due to Undue Hardship

- **Form 2210 - Underpayment of Estimated Tax by Individuals, Estates, & Trusts

- **Form 2555 - Foreign Earned Income Exclusion

- **Form 2848 - Power of Attorney and Declaration of Representative

- **Form 3520 - Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts

- **Form 5471 - Information Return of U.S. Persons with Respect to Certain Foreign Corporations

- **Form 8606 - Nondeductible IRAs

- **Form 8453 - U.S. Individual Income Tax Transmittal for an IRS e-file Return

- **Form 8821 - Tax Information Authorization

- **Form 8822 - Change of Address

- **Form 8865 - Return of U.S. Persons With Respect to Certain Foreign Partnerships

- **Form 8879 - IRS e-file Signature Authorization

- **Form 8938 - Statement of Specified Foreign Financial Assets

- **Form 12153 - Request for a Collection Due Process or Equivalent Hearing