QBO Dashboard Guide

See Udemy course

QBO Test drive - https://qbo-intuit.com/redir/testdrive

- QBO, How to Add…:

Section 2: Using QBO

The Chart of Accounts: adding accounts in QBO

- Access the Chart Of Accounts:

- On the left panel, select Menu>Transactions>Chart of Accounts>New(top-right)

-

Tags for categorization

- Access reports such as the Profit & Loss Statement:

- On the left panel, select Reports>Reports

Section 3: Customers

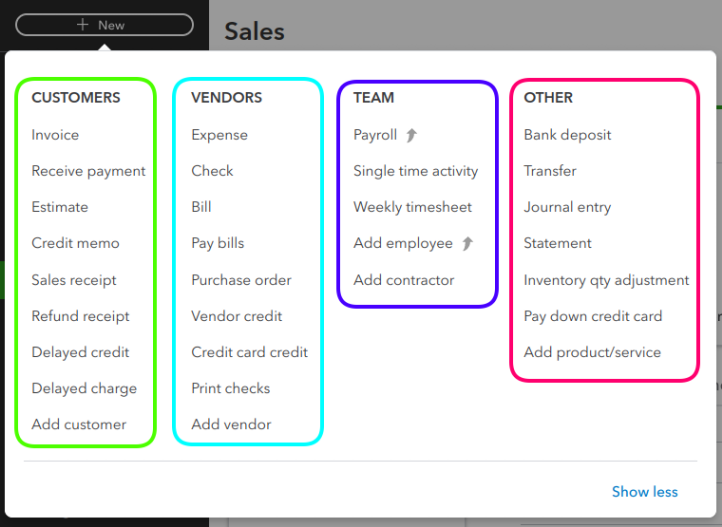

Set up Invoices, Estimates, Get Paid, Adjustments to invoices, Receipt of payments, Sales receipts

- Creating Customers And Maintaining Customer Information:

- On the left panel, select Sales>Customers

- Create a Customer Invoice And Email It!:

- On the left panel, select “+ New”>Invoice

- Create a Sales Receipt:

- On the left panel, select “+ New”>Customers>Sales Receipt

- Create Estimate:

- On the left panel, select “+ New”>Customers>Estimate

- Create a Credit Memo For adjusting bills using a new separate invoice:

- On the left panel, select “+ New”>Customers>Estimate

- How to Receive Payment from Customer:

- On the left panel, select “+ New”>Customers>Estimate

- Create Sales Receipt:

- On the left panel, select “+ New”>Customers>Sales Receipt

Section 4: Suppliers / Vendors

- Create a Supplier:

- On the left panel, select Expenses>Suppliers

- Create a Bill From A Vendor:

- On the left panel, select “+ New”>Bill

- Record a Payment To A Supplier:

- On the left panel, select “+ New”>Pay bills

-

See the Gear Icon on top-right gives additional settings

- Create Product Lines & Services Lines to sell:

- On the left panel, select Sales>Product and Services>New (top-right-green button) Allows you to set up $/hr.

- How to Input A Bill From A Supplier:

- On the left panel, select “+ New”>Vendors>Bill, set the bill number from the invoice, choose the category of the expense,

- Recording Payment To A Supplier:

- On the left panel, select “+ New”»Vendors>Pay Bills,

- Recording an Expense in QuickBooks;

- On the left panel, select “+ New”>Vendors>Expense,

Section 5: Reconciling Bank Act

-

Bank rules and receipts, using Amazon business apps to import expenses and receipts…

-

Create Rules - apply rules to transactions where money is going in/out with conditional Boolean statements for categorization, assigning these transactions to specific accounts, etc.

-

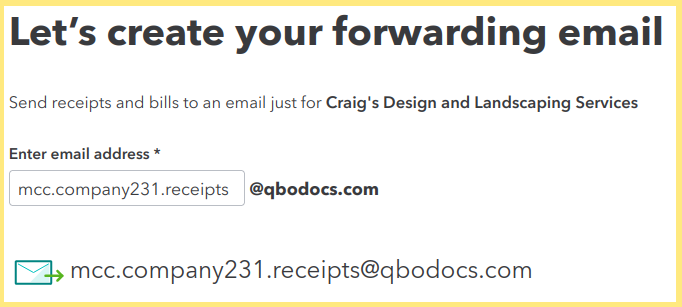

It is possible to upload receipts from your computer or phone or even have the receipts sent to an email address.

- Recording a Bank Feed - Linking Your Bank Account To QBO:

- On the left panel, select “+ New”>Bank Transactions>Link Account>Choose Bank>…

- Recording a Bank Feed - Adding Bank Transactions To QBO:

- On the left panel, select “+ New”>Vendors>Expense,

- How to Reconcile Bank Acts:

- First, obtain bank statement; on the top-right gear, Tools>Reconcile>Enter $ and dates

- Bank Feed - Matching Bank Transactions:

- Bank Transactions>Goto Category or Match>Choose transaction>Match

- receipt.forwarding.ex

Section 6: Payroll Overview: Using Payroll to pay employees

- How to use QBO Payroll can help with payroll taxes and paying by check or direct deposit, track benefits, add contractors

- Adding an employee

- On the left panel, select Payroll/Employee/Add an Employee/Pay or Profile or Employment / Add info /Save

- Running Payroll in QBO

- On the left panel, select Payroll/Employees/Run Payroll (On Right), and pay by paper check or direct deposit.

Section 7 TAXES

- Sales tax overview

- On the left panel, select Taxes/Get Started/Add biz address/Add state info /Review info / Save

- QBO can help you file and pay sales taxes/Select filing frequency (monthly/quarterly/yearly)

Overview: Filing sales tax returns - accrual vs cash basis. Different countries/governments may require a business to submit taxes based on when the money is received and not earned and vice versa.

- Set up Sales tax for products and services and use the sales tax module

- On the Right: Sales/Choose Inventory, Service, etc./Choose category/Add description/rate info/income account/choose sales tax cat./Save

- Recording sales tax in a sales transaction

- On top right <+New>/Customer/Invoice/add info/

- Recording sales tax in an expense transaction

- On the left panel, select

/Vendors/Expense/{New window}/Select Payee/Payment act./Select Act. category/from Cat. details/amount/Is tax applicable?/Select Product service or item/Add notes/Attach contract or quote, etc./Save

-

Sales Tax Summary report, how to find taxable sales

- On left side click Reports/{you can use search box, example taxable}/Choose taxable sales summary or detail/

- It is possible to drill down into details by clicking any sales item.

- It is possible to choose different periods…

- Reports can be saved!

Groupby…

-

Sales Tax Liability report, to help file taxes

- On left side click Reports/Search

/...

- Recording sales tax payment, how to file taxes!

- On left side click Taxes module/Goes to Sales Tax Center/Sales Tax Owed/Choose Accounting Basis: Accrual or Cash/choose period/

- Good for quarterly tax payments

Section 8: Examples & Practice: Sales & Customers

- Injecting capital (money) to start a company:

- DR Asset/bank account and then CR to Equity act

- On top right <+New>/Journal entry/Choose line #1/Bank act checking or savings/Add description/Save & close.

- To follow up goto Chart of Acts & check for DR. as well as a CR for ‘Share Capital’

- Purchasing Inventory on account

- On top right <+New>/Journal entry (screen)/ Enter into acct./Add: Inventory asset

- Ex. DR Inventory $1k

- CR A/P $1k

- /Add description/Save & close.

To Double check: Goto Chart of Acts by using Accounting on bottom left.

- Making sales to customers:

- Ex. you sell $100 receiving cash

- DR Asset/cash

- CR sales/revenue $100

- On top right <+New>/

- There are several ways to enter sales, Invoice + receive payment OR ‘Sales receipt’

- QBO sets up Invoice like register.

- Companies can sell 1. Non-inventory 2. Service 3. Bundle both parts and service

- Promoting your business Via Advertising Exp.